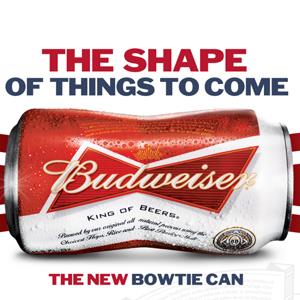

Budweiser tries putting same old beer in new cans

The bowtie-shaped 11.3-ounce container can't hide the fact that Bud sales have slid steeply in recent years.

When Budweiser sales slip, it's clearly not the beer's fault: It's

the cans.

When Budweiser sales slip, it's clearly not the beer's fault: It's

the cans.

Parent company Anheuser-Busch InBev (BUD -0.65%) has watched Budweiser's marketplace slide for a

good, long while now. In 2011, MolsonCoors' (TAP -2.23%) flagship product Coors Light replaced Bud as the

No. 2 beer in the country, breaking the grip A-B held on the Top 2 since

1993.

While Coors Light sales grew 9% in the five years

prior, Bud sales tanked 29%. It has lost more than 60% of its sales since its 50

million-barrel peak in 1988, when it accounted for more than 25% of all beer

sold in the U.S. For some perspective, Budweiser once held market share close to

that now held by both Miller and Coors brands combined (27%).

To combat this, A-B has commissioned

its canning facility in Newburgh, N.Y., to make Budweiser cans shaped like bowties to claw back some of its lost sales. The

cans are crimped in the middle, sold in eight-packs and hold 11.3 ounces of beer

compared to the 12 found in regular cans. Always looking on the bright side, A-B

notes that the missing 0.7 ounces knocks 8.5 calories off the content.

Budweiser could use a bit more of that one-sided

optimism. Until Beer Marketer's Insights reported an estimated 0.6% uptick in

Anheuser-Busch InBev sales for 2012, the big brewer had seen sales drop each

year since 2008.

It has thrown just about everything

at the wall trying to stop the bleeding. It has introduced "premium" brands like Budweiser Select, Budweiser American

Ale, Bud Light Platinum, Budweiser Black Crown and Bud Light Lime margarita flavors. It

purchased Chicago-based small brewer Goose Island from the Craft Brew Alliance (BREW -1.04%) last year. It's hosting its "Made In America" music festival in Philadelphia this August

with Beyonce and Nine Inch Nails, and it has been sponsoring pop culture site

A.V. Club's A.V.

Undercover performances in an attempt to get younger audiences to drink its

declining brand.

Recently, it ran afoul of the

Justice Department in a bid to take over Mexico-based Corona maker Modelo and

was forced to redo the deal and give up U.S. distribution of Modelo

products. The deal comes as imports and small American craft brewers take an

increasing share of big brewers' market share and profits.

MolsonCoors' Miller brands have faced similar issues. According to AdAge, Vince Vaughn, "Hangover III" co-star Ken Jeong, former

mixed martial arts star Chuck Lidell and drummer Questlove from The Roots are

all slated to appear in a new round of Miller Lite ads. It's a step away from

the Miller Lite "man up"

campaign and a nod to the brand's "Miller Lite All-Stars" glory days of the mid-'70s and

'80s.

Miller Lite's parent company also hopes a new bottle available

only in bars and restaurants starting in May will help stop the slide.

As Boston Beer

Co. (SAM -0.01%) joins other craft brewers like Oskar Blues, 21st

Amendment, Sierra Nevada and New Belgium by putting Samuel Adams in cans this

summer, those breweries and their growing consumer base will only add to the

pressures that have pushed A-B to squeeze its cans in the middle.

No comments:

Post a Comment